- Free Sample Cpa Exam Questions

- Sample Cpa Exam Questions And Answers

- Auditing Cpa Exam Sample Questions

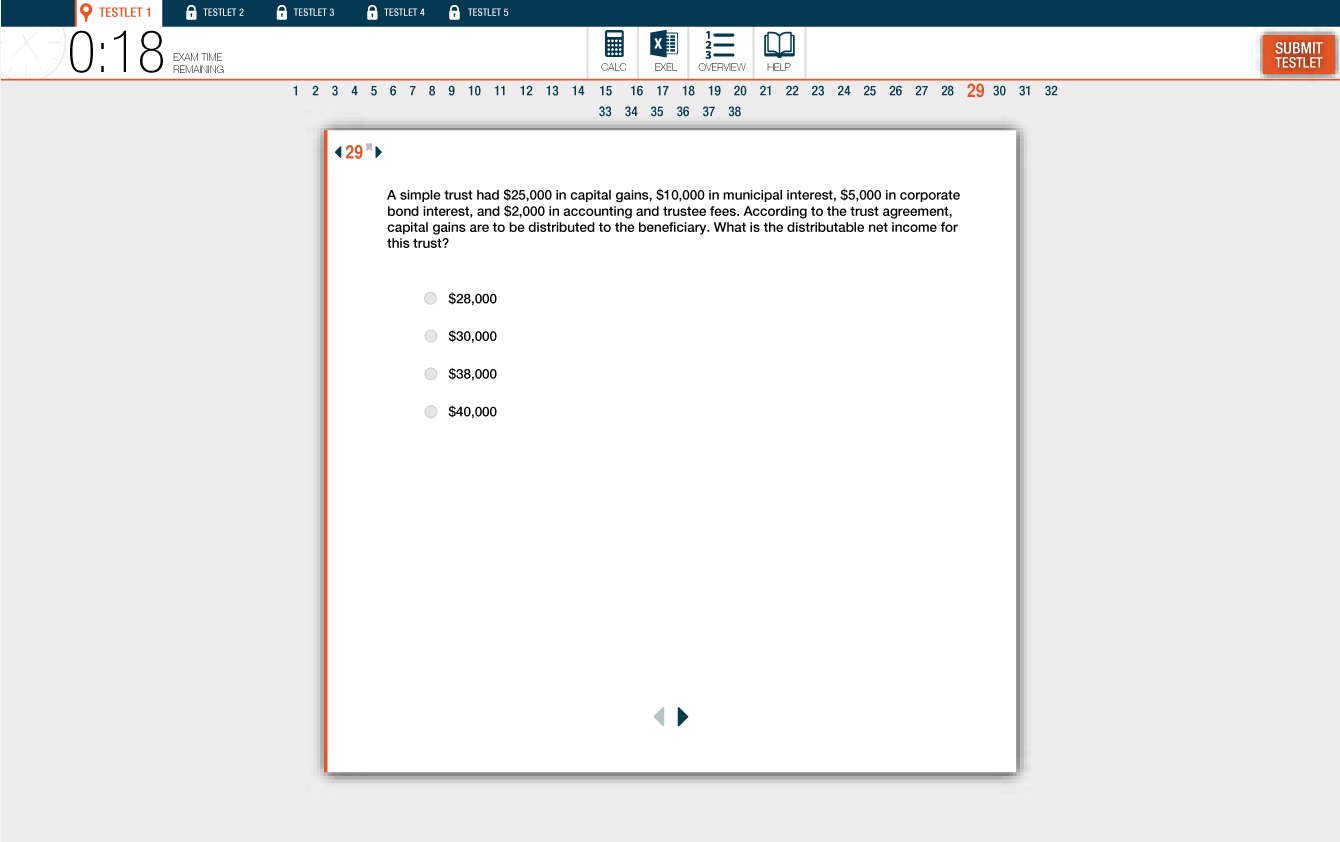

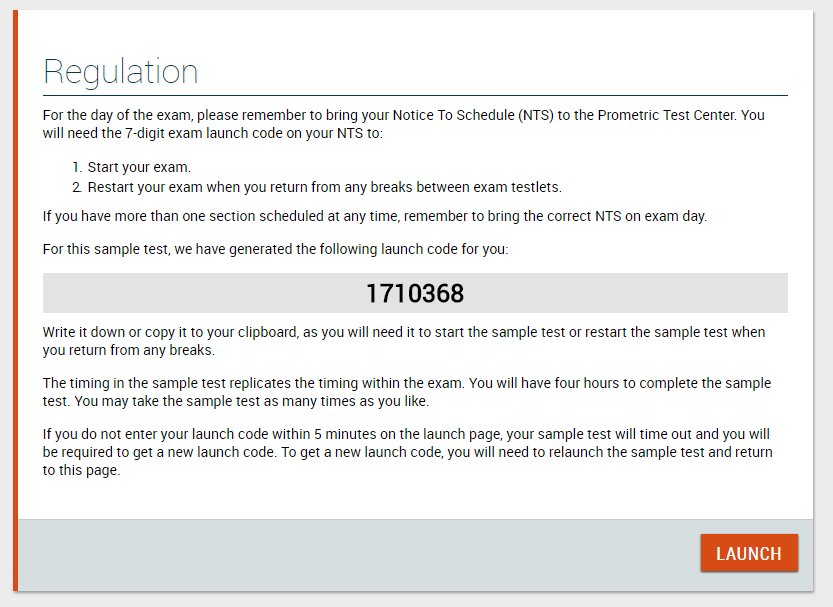

- Oct 06, 2019 This month, the AICPA has released an additional 140 free CPA Exam questions to all candidates. THIS NEVER HAPPENS! These questions are recently used questions on actual past CPA exam tests. These questions could be very helpful for understanding what types of questions have been tested to candidates in the very recent past.

- In addition, taking sample tests and answering sample questions can also help gauge performance and indicate areas that need further attention. On the day of the exam, it is important to make sure that all test items are answered, since leaving answers blank counts as incorrect responses.

Part 4 Sample Exam Questions In the Boston Consulting Group (BCG) growth-share matrix, which strategy in the matrix describes large generation of cash and heavy investment needed to grow and maintain competitive positioning but net cash flow is usually modest?

AUD can be sneaky; you’ll notice many of the questions include in general or most likely. That’s why having a thorough understanding of the material is key to passing the exam. According to the AICPA’s Content and Skill Specifications, the six general concepts tested on the AUD CPA exam are fairly evenly weighted. To gain a better understand of what is on the AUD exam, check out this post.

Below we have sample CPA AUD practice questions (and solutions) that pertain to each of the six content sections tested on the exam.

Sample CPA AUD Practice Questions

Auditing and Attestation: Engagement Acceptance and Understanding the Assignment

In auditing the financial statements of Durmstrang Corp., Krum discovered information leading Krum to believe that Durmstrang’s prior year’s financial statements, which were audited by Malfoy, require substantial revisions. Under these circumstances, Krum should

- Request Durmstrang to arrange a meeting among the three parties to resolve the matter.

- Notify Durmstrang’s audit committee and stockholders that the prior year’s financial statements cannot be relied on.

- Notify Malfoy about the information and make inquiries about the integrity of Durmstrang’s management.

- Request Durmstrang to reissue the prior year’s financial statements with the appropriate revisions.

Auditing and Attestation: Understanding the Entity and Its Environment (including Internal Control)

For effective internal control, the accounts payable department generally should:

- stamp, perforate, or otherwise cancel supporting documentation after payment is mailed.

- ascertain that each requisition is approved as to price and quantity by an authorized employee.

- obliterate the quantity ordered on the receiving department copy of the purchase order.

- compare the vendor’s invoice with the receiving report and purchase order.

Auditing and Attestation: Performing Audit Procedures and Evaluating Evidence

An auditor most likely would make inquiries of production and sales personnel concerning possible obsolete or slow-moving inventory to support management’s financial statement assertion of:

- presentation and disclosure.

- rights and obligations.

- valuation or allocation.

- existence or occurrence.

Auditing and Attestation: Evaluating Audit Findings, Communications, and Reporting

Under which of the following circumstances would a disclaimer of opinion not be appropriate?

- The auditor is unable to determine the amounts associated with an employee fraud scheme.

- Management does not provide reasonable justification for a change in accounting principles.

- The chief executive officer is unwilling to sign the management representation letter.

- The client refuses to permit the auditor to confirm certain accounts receivable or apply alternative procedures to verify

their balances.

Accounting and Review Services Engagements

For what types of professional engagements is a practitioner required to get a representation letter from management of the reporting entity?

- For an audit and a review, but not for a compilation.

- For an audit, a review, and a compilation.

- For an audit and a compilation, but not for a review.

- For an audit only.

Professional Responsibilities

As a result of the Sarbanes-Oxley Act, the PCAOB has been created. Which of the following is false?

- The PCAOB is a government agency.

- The PCAOB comes under the oversight and enforcement authority of the SEC.

- The PCAOB will be funded by fees charged to all registered accounting firms and publicly traded companies.

- All accounting firms that participate in the preparation of an audit report for a company that issues securities must register with the PCAOB.

Sample CPA AUD Practice Question’s Solutions

Auditing and Attestation: Engagement Acceptance and Understanding the Assignment

In auditing the financial statements of Durmstrang Corp., Krum discovered information leading Krum to believe that Durmstrang’s prior year’s financial statements, which were audited by Malfoy, require substantial revisions. Under these circumstances, Krum should

- Request Durmstrang to arrange a meeting among the three parties to resolve the matter.

- Notify Durmstrang’s audit committee and stockholders that the prior year’s financial statements cannot be relied on.

- Notify Malfoy about the information and make inquiries about the integrity of Durmstrang’s management.

- Request Durmstrang to reissue the prior year’s financial statements with the appropriate revisions.

Why? If during his audit the successor auditor becomes aware of information that leads him to believe that financial statements reported on by the predecessor auditor may require revision, he should request his client to arrange a meeting among the three parties to discuss the information and to resolve the matter.

Auditing and Attestation: Understanding the Entity and Its Environment (including Internal Control)

For effective internal control, the accounts payable department generally should:

Free Sample Cpa Exam Questions

- stamp, perforate, or otherwise cancel supporting documentation after payment is mailed.

- ascertain that each requisition is approved as to price and quantity by an authorized employee.

- obliterate the quantity ordered on the receiving department copy of the purchase order.

- compare the vendor’s invoice with the receiving report and purchase order.

Why? Agreeing the vendor’s invoice with the receiving report ensures that the company is only billed for what it receives. Agreeing the vendor’s invoice with the purchase order ensures that the company was billed correctly for what it ordered. Upon favorable agreement, an accounts payable voucher is prepared and submitted for payment.

Auditing and Attestation: Performing Audit Procedures and Evaluating Evidence

An auditor most likely would make inquiries of production and sales personnel concerning possible obsolete or slow-moving inventory to support management’s financial statement assertion of:

- presentation and disclosure.

- rights and obligations.

- valuation or allocation.

- existence or occurrence.

Why? Assertions about valuation or allocation deal with whether asset, liability, revenue, and expense components have been included in the financial statements at appropriate amounts. Inquiries and other tests designed to determine if inventory is obsolete or slow-moving will help provide assurance that inventory, which should be adjusted to lower of cost or market, is properly valued on the financial statements.

Auditing and Attestation: Evaluating Audit Findings, Communications, and Reporting

Under which of the following circumstances would a disclaimer of opinion not be appropriate?

- The auditor is unable to determine the amounts associated with an employee fraud scheme.

- Management does not provide reasonable justification for a change in accounting principles.

- The chief executive officer is unwilling to sign the management representation letter.

- The client refuses to permit the auditor to confirm certain accounts receivable or apply alternative procedures to verify their balances.

Why? A disclaimer of opinion states that the auditor does not express an opinion on the financial statements. It is appropriate when the auditor has not performed an audit sufficient in scope to enable him to form an opinion on the financial statements. A disclaimer would not be appropriate when the auditor determines that the financial statements contain a departure from GAAP, such as when the client’s management does not adequately justify a change in accounting principle. The other answers are incorrect because they are situations that could give rise to a disclaimer.

Accounting and Review Services Engagements

For what types of professional engagements is a practitioner required to get a representation letter from management of the reporting entity?

- For an audit and a review, but not for a compilation.

- For an audit, a review, and a compilation.

- For an audit and a compilation, but not for a review.

- For an audit only.

Why? A representation letter is a requirement for both an audit and a review engagement, but there is no such requirement when a practitioner performs a compilation.

Professional Responsibilities

As a result of the Sarbanes-Oxley Act, the PCAOB has been created. Which of the following is false?

- The PCAOB is a government agency.

- The PCAOB comes under the oversight and enforcement authority of the SEC.

- The PCAOB will be funded by fees charged to all registered accounting firms and publicly traded companies.

- All accounting firms that participate in the preparation of an audit report for a company that issues securities must register with the PCAOB.

Why? The Sarbanes-Oxley Act was set up in a manner such that the PCAOB would not be a government agency, but would operate as an independent, nonprofit body to oversee the reporting of financial results of public entities. To enable a proper degree of government control, the PCAOB is under the oversight and the enforcement authority of the SEC. The PCAOB is funded by fees charged to registered accounting firms and all publicly traded companies.

Sample Cpa Exam Questions And Answers

By the way, sign up for our 1 Week Free Trial to try out Magoosh GMAT Prep!